What Is The Journal Entry For Unrealized Gain Loss . The security investment will increase to reflect. the journal entry is debiting security investment and credit unrealized gain. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. journal entry examples from youtube video linked below. however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be transferring. Unrealized gains or losses impact the “other comprehensive. capital gains directly affect your balance sheet because they increase/decrease your cash and your asset in the journal entry itself (when. equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes.

from publish.illinois.edu

however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be transferring. The security investment will increase to reflect. journal entry examples from youtube video linked below. equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. capital gains directly affect your balance sheet because they increase/decrease your cash and your asset in the journal entry itself (when. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. the journal entry is debiting security investment and credit unrealized gain. Unrealized gains or losses impact the “other comprehensive.

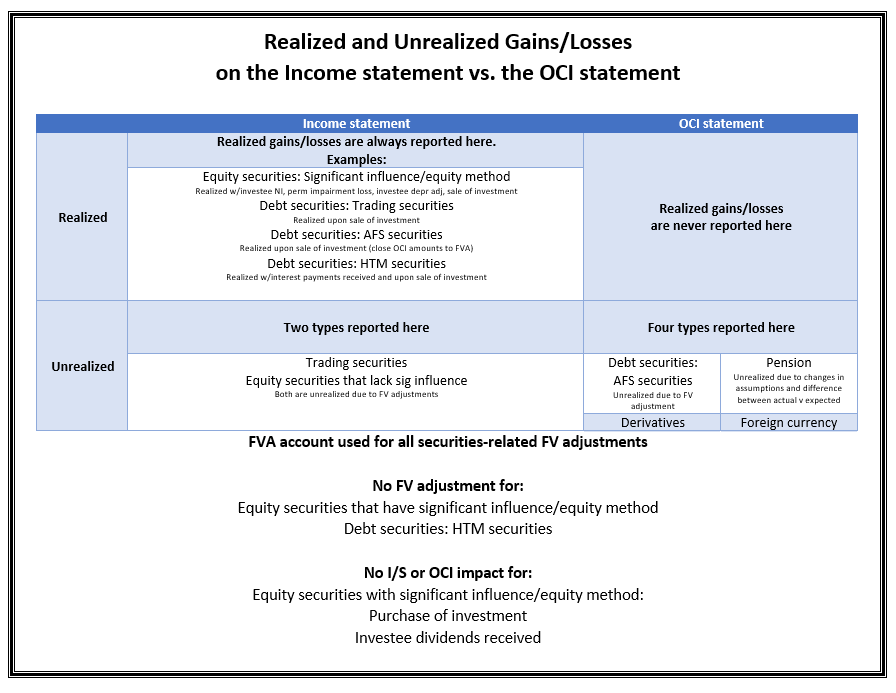

Realized and unrealized gains and losses on the statement vs OCI

What Is The Journal Entry For Unrealized Gain Loss journal entry examples from youtube video linked below. equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. The security investment will increase to reflect. journal entry examples from youtube video linked below. the journal entry is debiting security investment and credit unrealized gain. capital gains directly affect your balance sheet because they increase/decrease your cash and your asset in the journal entry itself (when. Unrealized gains or losses impact the “other comprehensive. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be transferring.

From exouhvmie.blob.core.windows.net

Journal Entry Unrealized Gain at Tracy Lewis blog What Is The Journal Entry For Unrealized Gain Loss The security investment will increase to reflect. the journal entry is debiting security investment and credit unrealized gain. equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. journal entry. What Is The Journal Entry For Unrealized Gain Loss.

From www.youtube.com

What is the entry to record the unrealized gain or loss? YouTube What Is The Journal Entry For Unrealized Gain Loss journal entry examples from youtube video linked below. the journal entry is debiting security investment and credit unrealized gain. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. The security investment will increase to reflect. however, then when the stock is sold, at that point, you have realized loss. What Is The Journal Entry For Unrealized Gain Loss.

From www.slideshare.net

Chap012 What Is The Journal Entry For Unrealized Gain Loss journal entry examples from youtube video linked below. Unrealized gains or losses impact the “other comprehensive. equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be. What Is The Journal Entry For Unrealized Gain Loss.

From www.cybrosys.com

How to Manage Unrealized Currency Gain/Losses in Odoo 16 Accounting What Is The Journal Entry For Unrealized Gain Loss journal entry examples from youtube video linked below. capital gains directly affect your balance sheet because they increase/decrease your cash and your asset in the journal entry itself (when. the journal entry is debiting security investment and credit unrealized gain. equity securities are accounted for as a portfolio, and only one journal entry is made each. What Is The Journal Entry For Unrealized Gain Loss.

From www.principlesofaccounting.com

Accounting For Asset Exchanges What Is The Journal Entry For Unrealized Gain Loss equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. capital gains directly affect your balance sheet because they increase/decrease your cash and your asset in the journal entry itself (when. journal entry examples from youtube video linked below. the journal entry is debiting security investment. What Is The Journal Entry For Unrealized Gain Loss.

From animalia-life.club

Accounting Journal Entries For Dummies What Is The Journal Entry For Unrealized Gain Loss equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. the journal entry is debiting security investment and credit unrealized gain. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. The security investment will increase to reflect. Unrealized gains or. What Is The Journal Entry For Unrealized Gain Loss.

From publish.illinois.edu

Realized and unrealized gains and losses on the statement vs OCI What Is The Journal Entry For Unrealized Gain Loss however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be transferring. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. journal entry examples from youtube video linked below. The security investment will increase to reflect. capital gains directly. What Is The Journal Entry For Unrealized Gain Loss.

From exouhvmie.blob.core.windows.net

Journal Entry Unrealized Gain at Tracy Lewis blog What Is The Journal Entry For Unrealized Gain Loss the journal entry is debiting security investment and credit unrealized gain. The security investment will increase to reflect. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. however, then. What Is The Journal Entry For Unrealized Gain Loss.

From wiki.autocountsoft.com

Unrealized Gain Loss AutoCount Resource Center What Is The Journal Entry For Unrealized Gain Loss however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be transferring. Unrealized gains or losses impact the “other comprehensive. capital gains directly affect your balance sheet because they increase/decrease your cash and your asset in the journal entry itself (when. journal entry examples from youtube video. What Is The Journal Entry For Unrealized Gain Loss.

From www.slideserve.com

PPT Chapter 10 PowerPoint Presentation, free download ID33049 What Is The Journal Entry For Unrealized Gain Loss the journal entry is debiting security investment and credit unrealized gain. The security investment will increase to reflect. equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. however, then when the stock is sold, at that point, you have realized loss or gain, then the journal. What Is The Journal Entry For Unrealized Gain Loss.

From accountedge.helpjuice.com

Recording Unrealized Currency Gains and Losses AccountEdge What Is The Journal Entry For Unrealized Gain Loss After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. capital gains directly affect your balance sheet because they increase/decrease your cash and your asset in the journal entry itself (when. journal entry examples from youtube video linked below. equity securities are accounted for as a portfolio, and only one. What Is The Journal Entry For Unrealized Gain Loss.

From www.youtube.com

How to make journal Entry for unadjusted Forex Gain/Loss YouTube What Is The Journal Entry For Unrealized Gain Loss equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. the journal entry is debiting security investment and credit unrealized gain. however, then when the stock is sold, at that. What Is The Journal Entry For Unrealized Gain Loss.

From docs.cmicglobal.com

Process Unrealized FX Gain/Loss What Is The Journal Entry For Unrealized Gain Loss After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be transferring. the journal entry is debiting security investment and credit unrealized gain. The security investment will increase to reflect. . What Is The Journal Entry For Unrealized Gain Loss.

From www.educba.com

Unrealized Gains and Losses (Explained , Examples) What Is The Journal Entry For Unrealized Gain Loss The security investment will increase to reflect. journal entry examples from youtube video linked below. capital gains directly affect your balance sheet because they increase/decrease your cash and your asset in the journal entry itself (when. however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be. What Is The Journal Entry For Unrealized Gain Loss.

From www.youtube.com

Unrealized Gains (Losses) on Balance Sheeet Examples Journal What Is The Journal Entry For Unrealized Gain Loss however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be transferring. The security investment will increase to reflect. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. journal entry examples from youtube video linked below. the journal entry. What Is The Journal Entry For Unrealized Gain Loss.

From accountinghw.blogspot.com

Accounting Hw Storm, Inc. purchased the following availableforsale What Is The Journal Entry For Unrealized Gain Loss equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be transferring. capital gains directly affect your balance sheet because they increase/decrease your cash and your asset. What Is The Journal Entry For Unrealized Gain Loss.

From wiki.autocountsoft.com

Unrealized Gain Loss AutoCount Resource Center What Is The Journal Entry For Unrealized Gain Loss capital gains directly affect your balance sheet because they increase/decrease your cash and your asset in the journal entry itself (when. however, then when the stock is sold, at that point, you have realized loss or gain, then the journal will be transferring. journal entry examples from youtube video linked below. After setting up the dedicated account,. What Is The Journal Entry For Unrealized Gain Loss.

From staging3.softledger.com

Foreign currency revaluation journal entry. Debit 170,000 to cash What Is The Journal Entry For Unrealized Gain Loss the journal entry is debiting security investment and credit unrealized gain. equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes. Unrealized gains or losses impact the “other comprehensive. After setting up the dedicated account, the next step involves creating a journal entry in quickbooks to. capital. What Is The Journal Entry For Unrealized Gain Loss.